Invest

Capital investment-capital protection is coming into focus

How can I link this to appreciation?

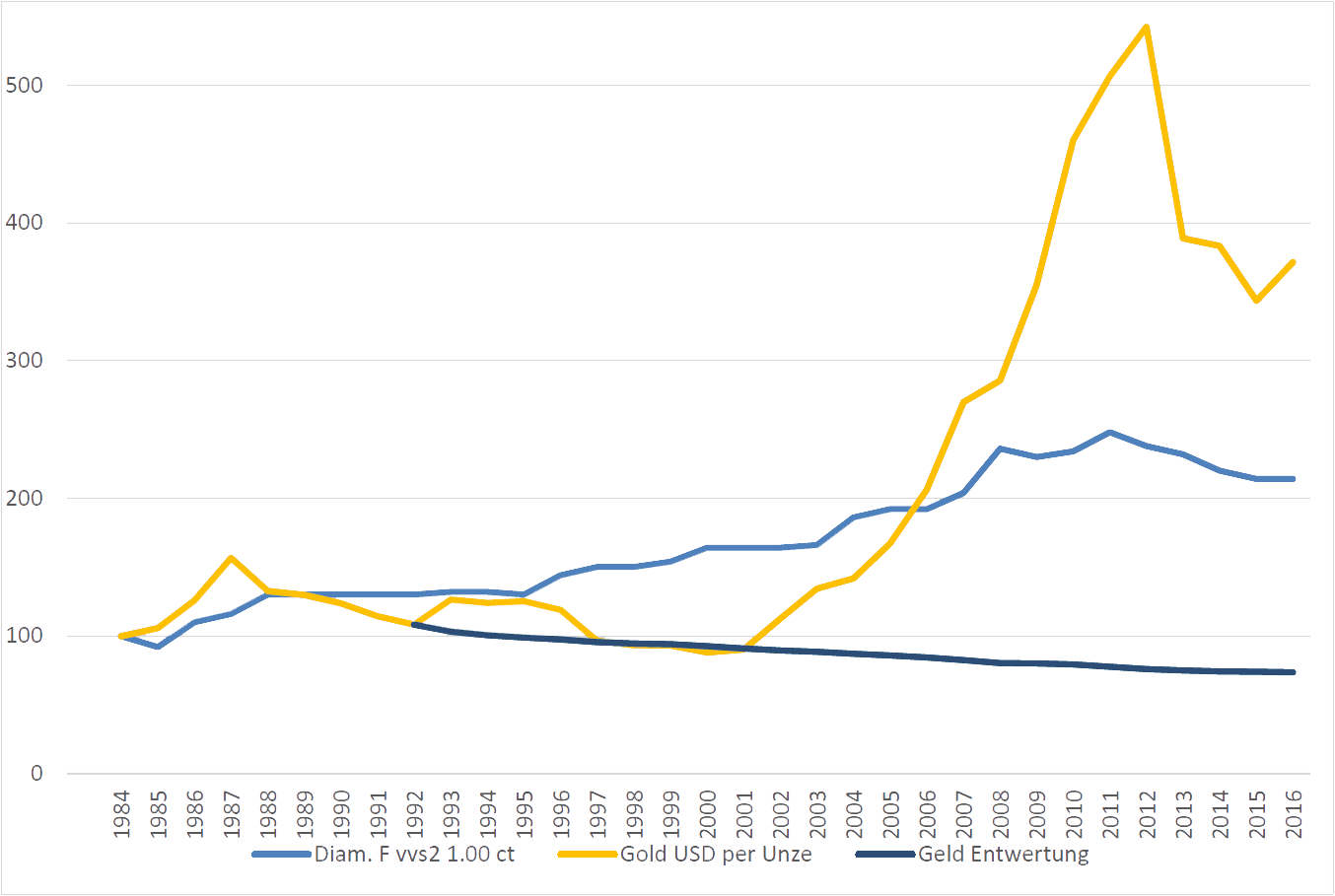

Euro crisis, bank failures, state bankruptcies and increasing inflation rates have stimulated massive interest in the investor community about investing in tangible assets. The currency war currently raging – or the battle for monetary global dominance, as it is often called – will greatly increase the volatility of the various asset classes and currencies. Described as the most important “non-paper money”, gold has trebled in the last ten years since the outbreak of the financial crisis, only to lose 40% of its value again in US$. Excessive government deficits and the persistently non-traditional monetary policy of the central banks have even pushed cyber currencies such as Bitcoin to post record price rises. Tech-savvy investors were already describing them as currencies of the future, until more and more flash crashes called this anticipated safety-mindedness into serious question. The fact that regulators and central bankers are losing influence and control over these parallel currencies means that their long-term intrinsic value is still highly questionable in future.

What is left for the investor community if it already has a 3% to 10% blend of precious metals in the portfolio? The shift in weightings in the various asset classes inflated by the central banks (bonds, equities, real estate, etc.) has since produced a small diversification effect as the correlations remain at a uniquely high level due to a flood of liquidity from central banks.

Is the only doctrine that of central banks with their paper money?

Other than precious metals, is there another diversification option for increasing the capital protection in your portfolio?

Yes there is – diamonds. Here, clear segmentation means that they not only produce an enormous diversification effect but will also see significant appreciation against the major currencies in the coming years.

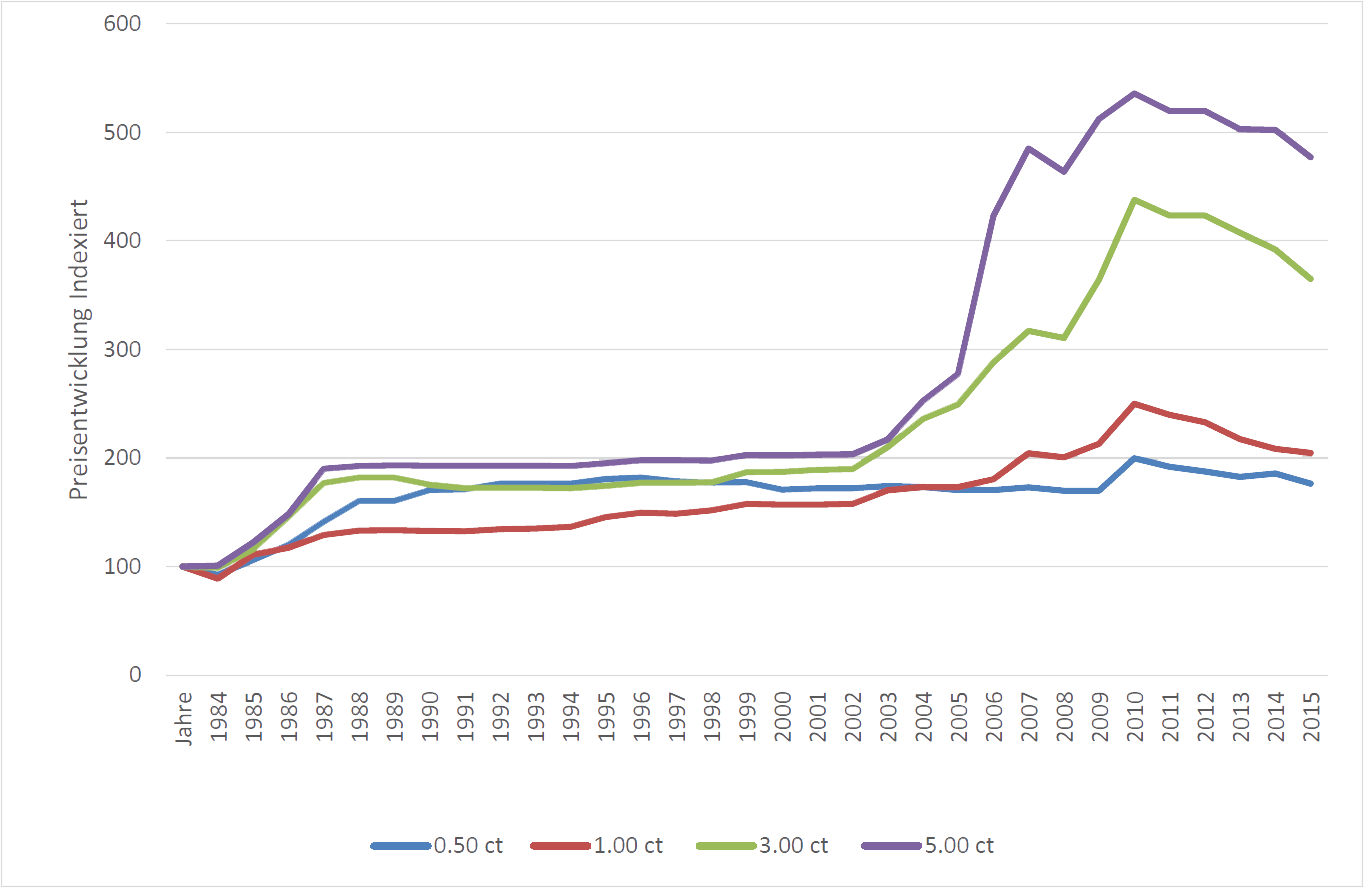

The three main segments of diamonds, namely 0.1 to 0.9 carat, 1 to 1.99 carat and the collector segment of over 2 carat, are logically subject to various demand cycles and therefore cover fundamentally different needs.

The pricing of small brilliants used mainly in the jewellery industry for bezels, etc., reflects economic trends, and these diamonds demonstrate a much greater correlation to the capital market, particularly the equity market.

Diamonds in the 1-carat-plus segment are correspondingly less common in nature, demand for them is also much more stable and subject to fewer economic cycles. Diamonds of between 1.00 and 1.25 carat in particular will see constantly higher demand due mainly to the demographic situation in India, China and Japan. In these latitudes in particular, it is imperative that an engagement or marriage is also expressed in symbolic terms. Appreciation is almost the same with a 1-carat diamond and therefore a compulsory proposal gift. The surplus of men in India and China has been continually increasing in the last few decades, resulting in six men for every five women among the 20- to 30-year age group, and this trend is rising. It almost goes without saying that the 4Cs (carat, cut, colour and clarity) in this emotionally charged segment are crucially important.

In the market, 2, 3, 4 or 5-carat-plus diamonds are similar to the art trade segment in that they represent prestige and are a discreet place for the super-rich to park their money. As in the art trade, however, the trading margins in this segment are much broader and the volumes lower, which boosts the collector effect and therefore corresponds less to the purpose of an actual investment instrument.

The cost of mining the world’s “hardest currency” has risen exponentially in paper money since the financial crisis, but this massively increased investment volume has not led to increased production in carats. The medium to large-carat diamond segments in particular have not reported any marked increase in mining.

Stability and corresponding appreciation potential stem from the fact that higher mining costs, existing mines that are largely exhausted and falling margins against the background of stable prices are offset by groups with high birth rates that are of marriageable age in Asia. As only one single diamond mine globally (Canada) has closed since the financial crisis, this status quo is set to be maintained over the next few years – production capacity at the Ekati Diamond Mine in particular will be significantly reduced again in the next five years.

Existing mines that are becoming exhausted, no new ones being opened in the foreseeable future and rising demand in the 1-carat segment not only provides the optimum diversification (reduction in volatility in the overall portfolio) but is the tincture that will emerge from increases in value.

Regular custody account discussions and market analyses are part of our service and definitely serve as the optimum entry into a segment that you may not be familiar with.

We are happy to advise you on how you can successfully invest in the world’s hardest currency.